Facts About Guided Wealth Management Revealed

Table of ContentsSome Known Facts About Guided Wealth Management.The Main Principles Of Guided Wealth Management The Basic Principles Of Guided Wealth Management Some Ideas on Guided Wealth Management You Need To KnowIndicators on Guided Wealth Management You Need To Know

Right here are 4 points to think about and ask on your own when determining whether you must touch the know-how of a financial consultant. Your total assets is not your revenue, however rather an amount that can aid you recognize what cash you make, just how much you conserve, and where you spend cash, also.Properties consist of financial investments and checking account, while liabilities consist of bank card bills and home mortgage settlements. Of program, a positive internet well worth is far better than an unfavorable total assets. Searching for some direction as you're assessing your monetary situation? The Consumer Financial Defense Bureau provides an online test that helps determine your financial health.

It's worth keeping in mind that you don't need to be well-off to seek guidance from an economic consultant. A significant life modification or choice will certainly activate the choice to browse for and hire a financial expert.

These and other significant life events might prompt the need to check out with an economic expert about your financial investments, your economic objectives, and various other monetary matters (retirement planning brisbane). Allow's claim your mother left you a neat sum of cash in her will.

Fascination About Guided Wealth Management

In basic, a financial expert holds a bachelor's degree in an area like finance, audit or service management. It's likewise worth nothing that you could see a consultant on an one-time basis, or job with them a lot more on a regular basis.

Anybody can claim they're a financial expert, but an advisor with professional designations is ideally the one you must work with. In 2021, an estimated 330,300 Americans worked as individual financial experts, according to the U.S. Bureau of Labor Data (BLS).

Unlike a registered representative, is a fiduciary who have to act in a client's ideal interest. Depending on the value of properties being handled by a signed up financial investment expert, either the SEC or a state safeties regulatory authority manages them.

Some Known Factual Statements About Guided Wealth Management

As a whole, however, financial preparation professionals aren't overseen by a single regulatory authority. An accounting professional can be thought about a monetary planner; they're regulated by the state accountancy board where they practice.

Offerings can include retirement, estate and tax planning, along with investment monitoring. Wealth supervisors generally are signed up agents, suggesting they're controlled by the SEC, FINRA and state protections regulatory authorities. A robo-advisor (retirement planning brisbane) is an automatic online investment manager that counts on formulas to care for a client's assets. Customers normally don't gain any human-supplied economic guidance from a robo-advisor solution.

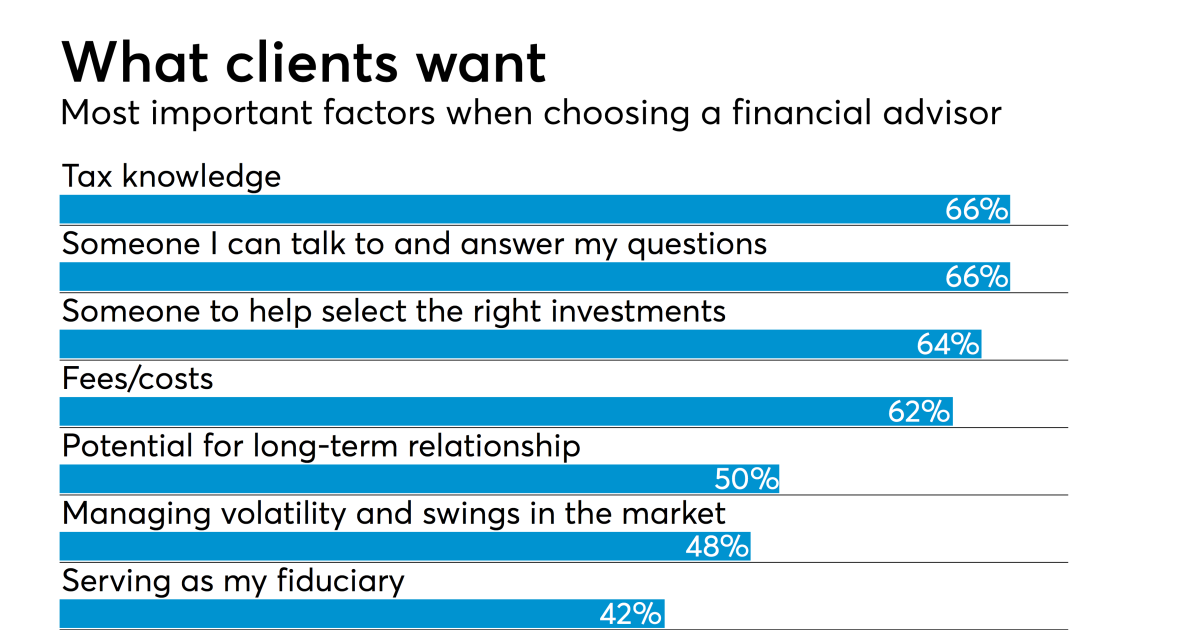

They make money by charging a fee for every profession, a level month-to-month fee or a percent fee based on the buck quantity of assets being handled. Investors trying to find the appropriate advisor needs to ask a number of concerns, including: A financial expert that deals with you will likely not be the exact same as a monetary consultant who collaborates with another.

Not known Incorrect Statements About Guided Wealth Management

Some advisors might profit from offering unneeded items, while a fiduciary is legally needed to pick financial investments with the client's demands in mind. Deciding whether you require an economic expert entails reviewing your financial circumstance, establishing which kind of monetary advisor you require and diving right into the background of any financial consultant you're believing of employing.

Allow's state you intend to retire (wealth management brisbane) in 20 years or send your youngster to a personal college in ten years. To complete your objectives, you may require a proficient professional with the ideal licenses to help make these plans a reality; this is where a financial advisor can be found in. Together, you and your consultant will certainly cover lots of topics, consisting of the quantity of money you must save, the sorts of accounts you need, the sort of insurance policy you ought to have (including lasting treatment, term life, special needs, and so on), and estate and tax obligation preparation.

Guided Wealth Management Can Be Fun For Anyone

At this point, you'll likewise let your expert recognize your investment choices. The first assessment might also include an exam of other monetary management topics, such as insurance coverage problems and your tax obligation circumstance.